Australia is updating its Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) laws to better prevent financial crimes and align with global standards. These changes are essential to protect the nation’s financial system and meet international expectations.

Background

In 2015, the Financial Action Task Force (FATF) highlighted gaps in Australia’s AML/CTF laws, especially noting that certain professions like lawyers, accountants, real estate agents, and dealers in precious metals and stones were not regulated. This oversight raised concerns about Australia’s exposure to financial crimes and the risk of being ‘grey-listed’ by FATF, which could harm the economy and the country’s reputation.

Key Reforms

The new laws, passed on November 29, 2024, aim to address these issues by:

- Expanding Coverage: Including high-risk professions such as lawyers, accountants, real estate agents, and dealers in precious metals and stones under AML/CTF regulations.

- Modernizing Rules: Updating regulations to cover digital currencies and virtual assets, ensuring they are in line with current technologies.

- Simplifying Compliance: Making the rules clearer and more practical to help businesses comply effectively.

Implications for Businesses

With these reforms, professionals in the newly included sectors will need to:

- Conduct Risk Assessments: Evaluate the potential risks of money laundering and terrorism financing in their operations.

- Implement Internal Controls: Establish policies and procedures to detect and prevent suspicious activities.

- Train Staff: Ensure employees are aware of AML/CTF obligations and can identify and report unusual transactions.

While these steps may require additional resources, they are crucial for closing loopholes that criminals exploit.

Economic and Reputational Impact

Failing to implement these reforms could lead to Australia being ‘grey-listed’ by FATF, placing it alongside countries with inadequate AML/CTF controls. This designation could result in increased transaction costs, reduced foreign investment, and damage to Australia’s international standing. Conversely, adopting the reforms will enhance financial integrity and align Australia with global best practices, fostering greater trust and economic stability.

Challenges and Considerations

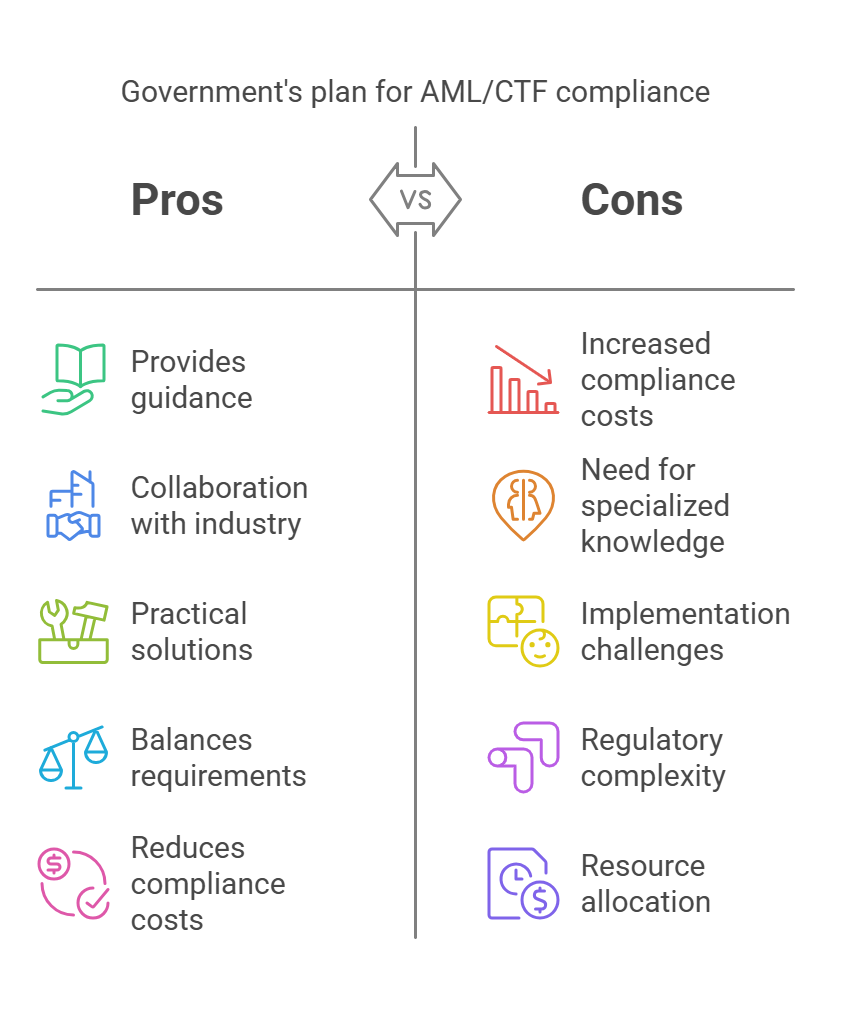

Small and medium-sized businesses may face challenges such as increased compliance costs and the need for specialized knowledge to implement effective AML/CTF programs. To address these concerns, the government plans to provide guidance and collaborate with industry stakeholders to develop practical solutions that balance regulatory requirements with operational realities.

How Remitso Can Assist

At Remitso, we understand that adapting to new AML/CTF regulations can feel overwhelming. That’s why we provide expert AML consultation services to help businesses develop risk-based strategies, implement compliance policies, and train their teams effectively. Our solutions include risk assessments, transaction monitoring guidance, and policy development, ensuring businesses meet regulatory requirements without unnecessary complexity.

With Remitso as your compliance partner, you can focus on growing your business while we help you stay ahead of regulatory changes—efficiently and stress-free.